Topic: Markets

Your Chinese Supplier Pollutes – It Dents Your Stock Price?

The market penalizes customers’ shares more than those of the polluter

Clues to the Market When Mortgage Originators Delay Securitization

With high-quality borrowers hard to judge from afar, Alt-A market offers quiet signal on creditworthiness

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

You Call That Fun? Why Individual Stock Investors Bother

Avanidhar Subrahmanyam studies how some investors’ gambling mentality affects share prices

When Younger Investors Overreact to News, Others Feel It

Inexperienced investors, lacking historical context, impact markets

Does Big News Drown Out Corporate Earnings Disclosures?

Henry Friedman’s research finds, surprisingly, that major economic news actually heightens attention paid to company announcements

In China, Big Investors Have Brilliant Timing ― Or Do They Know Someone?

A scan of a million brokerage accounts finds the wealthy trade ahead of market-moving news

How Very Small Stocks Skew Investing Wisdom

Well-known market anomalies are largely absent among the biggest stocks

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker

The Limited Payoff in Auto Insurance Advertising

Ads aimed at brand awareness are shown to be more effective

Citizens Are Not Fooled by Fake Statistics

What happened when the Argentine government lied about inflation numbers?

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

Keynes vs. FDR: Lessons from the Great Recession

Sebastian Edwards finds Keynes’ public take-down of Roosevelt’s gold policies still relevant today

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines

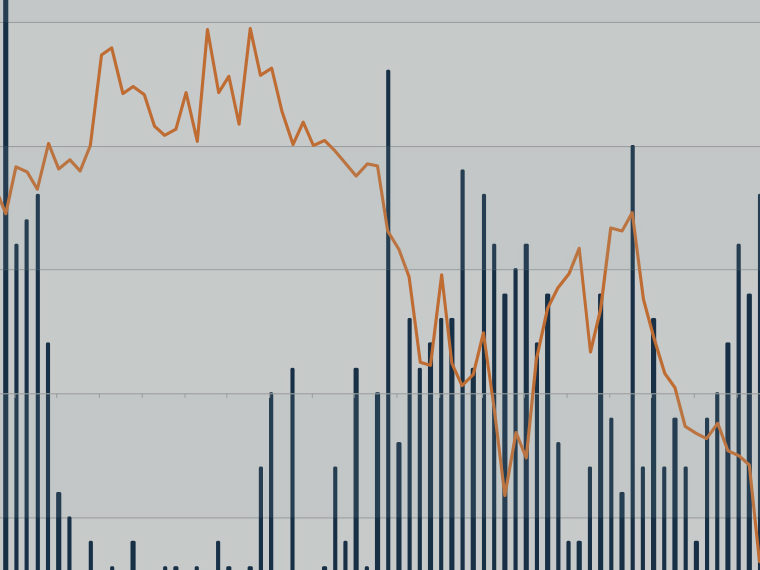

New Appreciation for a Classic Stock Market Gauge

The relationship between short- and longer-term moving averages has strong predictive power for share price returns

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts