Topic: Markets

Often Reviled, Short Sellers Are Newly Vulnerable to the Meme Mob

A short squeeze can ripple across short sellers’ positions

Separating Auditing from Consulting: More Complex than it Seems

Market concentration, price and quality drive choice of firms

Borrowings Suggest Small Company Owners Face Higher Risk

Analysis uses business credit card loans to gauge market perception

Market Bubbles Aren’t Entirely Irrational Exuberance

A model examines the relationships between innovation, speculation and market values

Out of the 1990s Asian Crisis, a New Bond Market Rises

Local currency sovereign bonds transfer risk from issuer to buyer

Corporate Bond Market Meltdown Averted after Fed Action

Decade-old bank-risk limits may have exacerbated liquidity problems

One European Country Defaults: How Hard-Hit Is the Euro?

A predictive model employs credit default swaps across currencies

Does Better Corporate Disclosure Boost Markets?

Stronger financial reporting standards seem to mean more for growth of countries’ credit markets than their stock markets

At Last, the Momentum Investing Puzzle Solved?

The simplest explanation — “I can’t believe you know something I don’t” — may trump all the rest

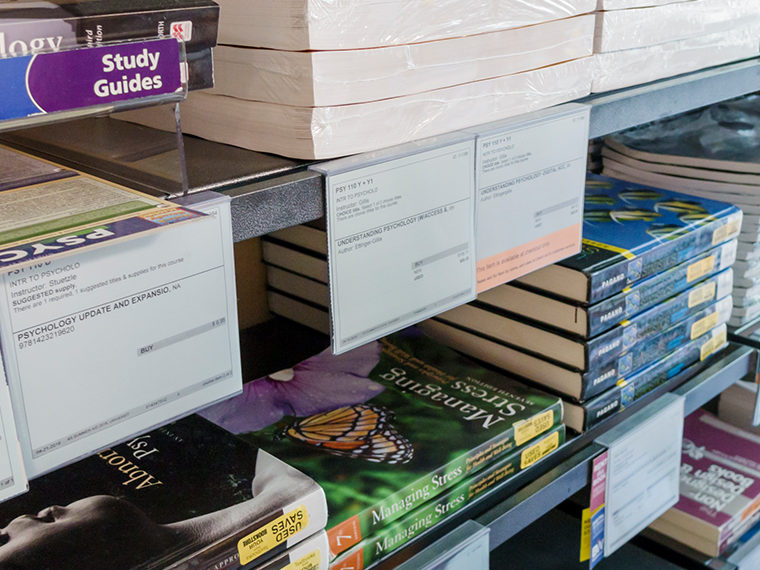

Is Anyone Happy about the College Textbook Market?

Buyers find the tomes heavy, costly and too frequently revised, while sellers might like to kill the used book market entirely

A Tool for Finding Mispriced Stocks

Less sophisticated investors reveal their sentiment in certain trades, and a 20-year study measures it company by company

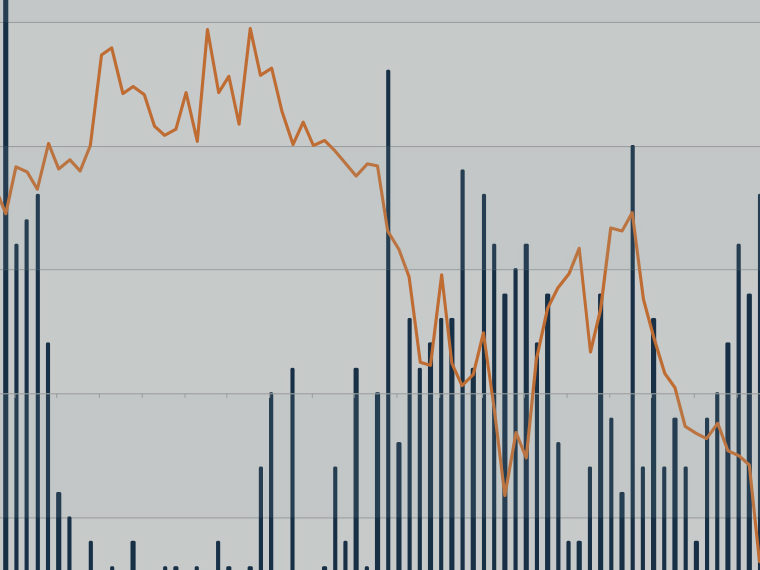

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

Fairness in the Allocation of Scarce Goods and Services

As alternative pricing schemes proliferate, researchers examine beliefs about their fairness

What Makes a True Financial Crisis?

Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

New Appreciation for a Classic Stock Market Gauge

The relationship between short- and longer-term moving averages has strong predictive power for share price returns