Topic: Stock Market

Options Market Signals Scope of Federal Reserve Interventions

Traders see an implicit promise beyond specific asset purchases

Political Football: Inclusion of ESG Funds in 401(k)s

In nation accustomed to litigation, availability of funds has varied by U.S. Circuit Court boundary

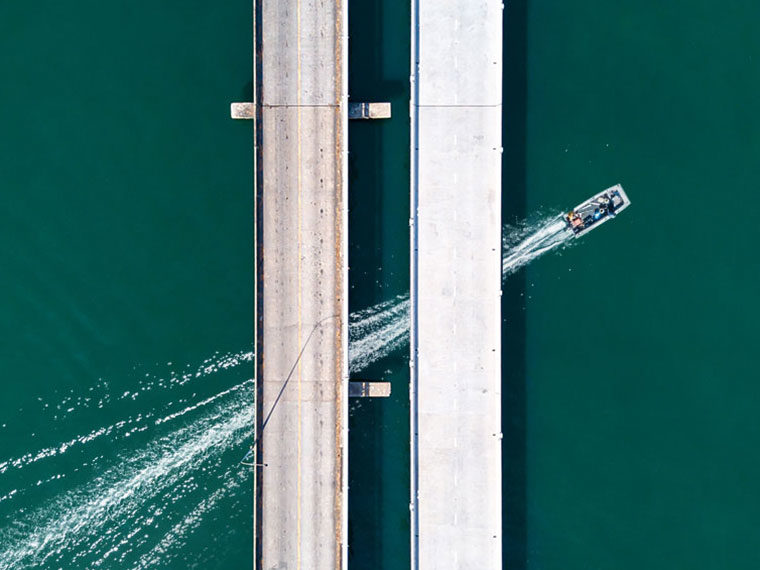

Politicians and Labor Love Reshoring; Investor Reaction Is Mixed

Stock prices dip around some announcements of return of jobs

Prediction Markets + Polls + Economic Indicators: Better Election Forecasting?

A model incorporating markets that allow betting on elections suggests a role in prognostications

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

The Mechanics of How Social Media Turbocharges Asset Bubbles

Establishment media coalesces around a lone narrative, but online chatter hops between storylines, sometimes shocking traders

Tweets with Visuals Bring a 2% Stock-Price Boost — Temporarily

SEC encourages graphics in disclosures, but this practice may help executives more than shareholders

Underappreciated Investment Edge: Company Trademark Filings

Not part of financial reporting, trademark activity predicts stock returns

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

What Limited Attention Does to Efficient Market Theory

Stocks don’t react to news immediately because, well, we’re human

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

When Individuals Concentrate in a Stock, Earnings Surprises Play Out Differently

Price movements can be more extreme

Why Rising Stocks Sometimes Reverse, Then Rally

Cultural differences and investor behavior can drive reversals and momentum

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact

Why Would a Hedge Fund Manager Reveal Stock Positions?

A model suggests that the data might lead index funds to target those same stocks in oversight of corporate management