Area: Finance

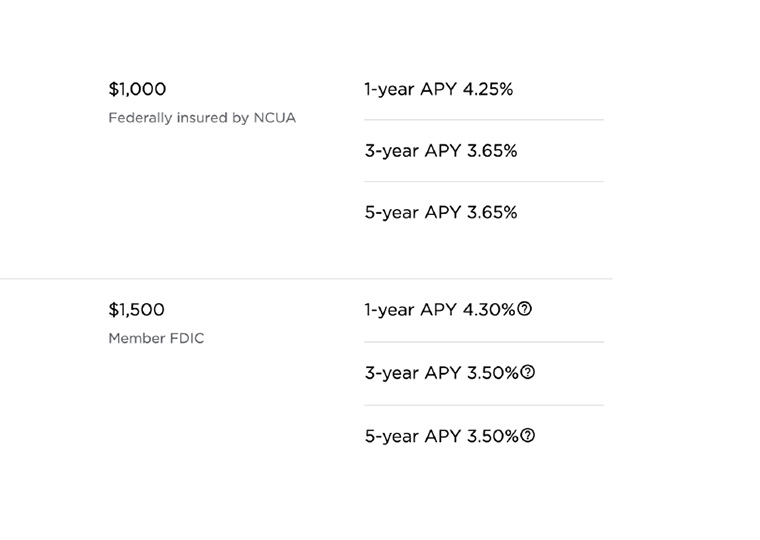

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

Prediction Markets + Polls + Economic Indicators: Better Election Forecasting?

A model incorporating markets that allow betting on elections suggests a role in prognostications

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

Inclusion in an ETF Can Improve the Pricing of Underlying Stocks

It can also help management make capital expenditure decisions

Political Football: Inclusion of ESG Funds in 401(k)s

In nation accustomed to litigation, availability of funds has varied by U.S. Circuit Court boundary

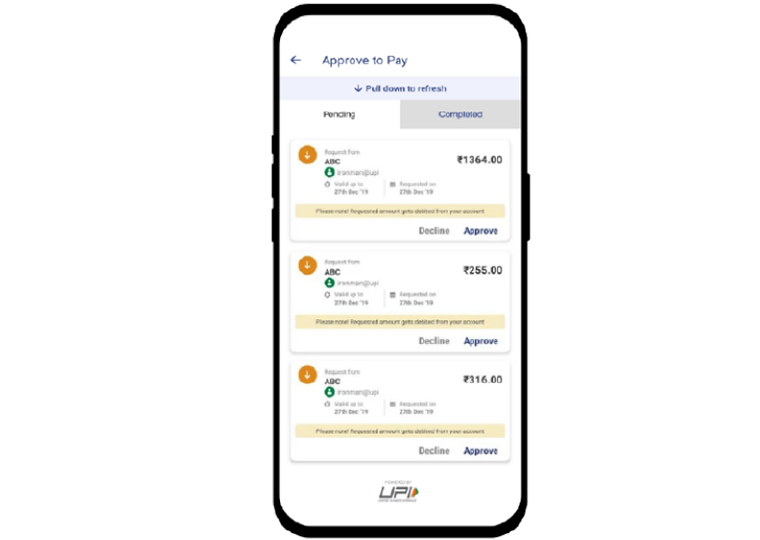

Cashless Payments: Faster Transactions, Easier Borrowing and Increased Household Income

System provides digital record of payments for India’s vast self-employed ranks, satisfying lenders, and raising the likelihood of starting a business

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

Why Big Banks Can Pay Less on Deposits

Their level of technology and services makes up for it; it’s vice versa with little banks

Can Banks, Disrupted by Fintech, Adopt New Habits, Too?

In China, patent data shows commercial banks’ use of new technologies helps improve efficiency and reduce risk

Local Banks Provide an Early Warning System on Recessions

When they’re forced to pay up for deposits, it’s a bad sign for area’s economy

Loan Pool Covenants, Meant to Contain Risk, Can Instead Spread It

Forced sale of assets could stretch illiquidity across industries

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

Migration — and Home Price Escalation — Happens Along Established Routes

Major cities reliably feed residents to the same smaller markets, and housing booms predictably travel with them

Looming Risk to Financial System: $1 Trillion in Commercial Loan Pools

Known as collateralized loan obligations, their aim is actually to reduce risk