Area: Finance

Underappreciated Investment Edge: Company Trademark Filings

Not part of financial reporting, trademark activity predicts stock returns

Dealers Might Not Profit from Soaring Used-Car Prices

Lenders and private-party sellers constrain a seeming windfall

GameStop Aside, Retail Investors Might be Terrible at Momentum Investing

Using Chinese A and B shares, institutional players outperform individuals

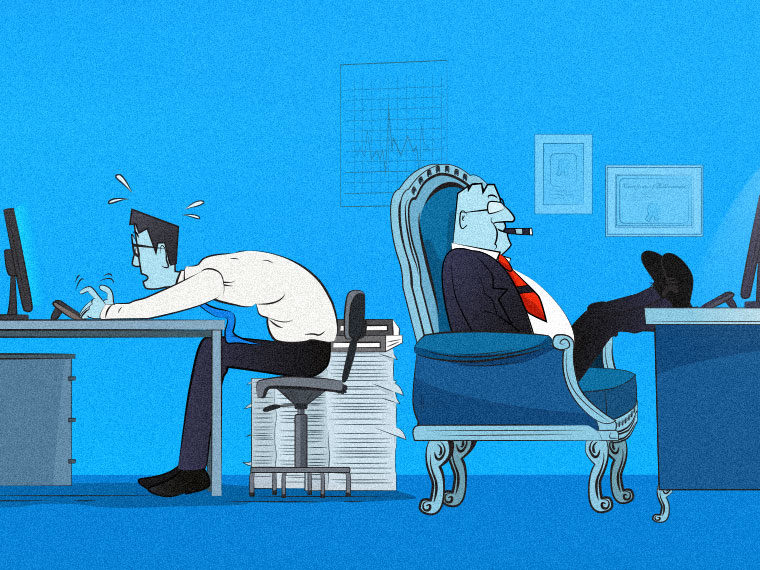

Employee or Capitalist? Equity Compensation Merges the Two

Labor’s losses to capital, much studied, aren’t quite as grim when stock and options are tabulated

As Passive Investing Spreads, Overall Market Becomes Less Competitive

Active investors take up some — but not all — of the slack created by index funds

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

It’s a Startup — and Almost Certainly a Future Acquisition by a Tech Giant

Patent histories show entrepreneurs focused on exit strategy

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

How Commodity Price Swings Destabilize Bank Relationships

Small firms in Peru shop nationwide for cheap credit, but loyalty runs two ways

One Data Set That Warns Against Margin Trading

As a group, Chinese futures traders more likely to suffer margin call than to profit

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

Often Reviled, Short Sellers Are Newly Vulnerable to the Meme Mob

A short squeeze can ripple across short sellers’ positions

Borrowings Suggest Small Company Owners Face Higher Risk

Analysis uses business credit card loans to gauge market perception

Heading for a Divorce? Might Want to Go Easy on Stock Picking

Active traders lose their edge as a marital breakup approaches

COVID-19-Induced Eviction Moratoria Reduced Hunger and Anxiety

Housing guaranteed, rent payments went toward food

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact