The troublesome relationship between tariffs, trade deficits and the tenuous economic recovery

Would a smaller trade deficit make the U.S. economy stronger?

The question is only a portion of the contentious debate over U.S. tariffs on Chinese imports. Economic theory and existing empirical evidence strongly indicate that tariffs do not in general create the conditions for faster economic growth.

Escalating trade wars “are the stuff that global slumps are made of,” cautions the June 2019 UCLA Anderson Forecast report. Signs of trade friction cropping up in other economic data — and the potential for more friction — are, in part, behind the forecast’s increased probabilities of a U.S. recession in the next three years versus previous outlooks.

Opt In to the Review Monthly Email Update.

While trade wars are nearly universally disfavored in the community of established economists, trade deficits generate a healthy and respectful debate among experts: Should economic policy focus on reducing the trade deficit?

To fund the ballooning federal budget deficit, the U.S. actually requires a similar trade deficit. Otherwise, the government’s need for cash would potentially crowd out investment elsewhere in our economy.

Policymakers have to consider this financial imperative against security in some cases: Should the U.S. be reliant on foreign producers for crucial products and commodities? Also, globalization’s impact on jobs and wages has become a part of the debate over tariffs and trade deficit reduction.

But tariffs do have economic consequences at home that are counterproductive to economic growth, including disruption of supply chains. Yes, replacement suppliers can usually be established over time in nations not affected by tariffs, but these arrangements take time and are often less efficient.

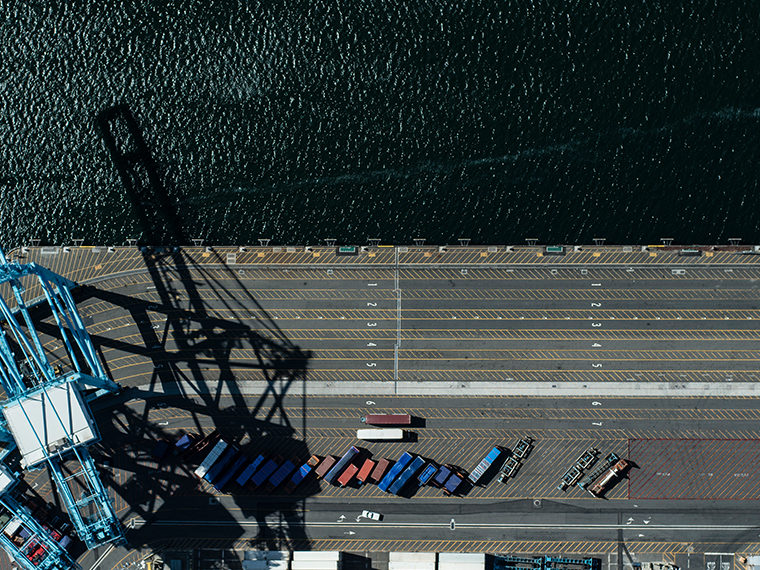

This warning is illustrated in an article by UCLA economist William Wu and Forecast director Jerry Nickelsburg, included in the latest quarterly Forecast report. A study of recent trade flows shows how the trade war with China has dramatically dropped imports from there but has done little to reduce the overall trade deficit.

The table below shows how other U.S. trading partners have picked up business China lost. Comparing the first quarter of 2019 to the same in 2018, we see that the U.S. imported more goods this year than last from all of its major trading partners except China and Canada.

The European Union became the U.S.’s biggest trading partner, widening the trade deficit between the two in its favor. Several countries that sell more to the U.S. than they buy, including Japan, Vietnam and South Korea, also increased trade here during the study period.

The fluctuations in trade with these countries largely reflect U.S. company attempts to use suppliers in places where new tariffs won’t add costs. But the disruption to supply chains, like the addition of tariffs on the hundreds of billions of dollars of goods still imported from China, are costs that companies will pass on to customers, the Forecast warns. Regardless of where the U.S. trade deficit emerges from, tariffs aimed at narrowing it will increase prices for goods sold to Americans.

Meanwhile, other side effects of tariffs work to boost the trade deficit rather than lower it, the findings suggest. The trade disputes have sent the value of the dollar up sharply against the Chinese yuan, the study notes. For China, this change offsets the pain of new tariffs by making Chinese products less expensive in comparison to U.S. goods. It’s one reason the U.S. trade deficit with China grew in April, despite tariffs.

The effects cited in the Forecast have only grown. The researchers note that the first quarter, on which the report is based, ended before the latest escalation of the trade dispute. In May and June, President Trump greatly expanded the China tariffs and added the European Union, Canada and Mexico as real or potential targets for higher tariffs. Retaliation — higher tariffs on U.S. exports by target countries and their friends — is ongoing.

Unfortunately, the fastest way to reduce the trade deficit is for all of America, which includes government as well as individuals and companies, to stop spending so much. Harvard economist Martin Feldstein, a former chairman of the Council of Economic Advisers, explained why in a paper titled “ Inconvenient Truths about the U.S. Trade Deficit.” (Feldstein died on June 11, 2019.)

The U.S. trade deficit, as the Forecast notes, is not defined by the level of trade with individual countries. Instead, the trade imbalance reflects the fact that Americans consume more than they produce. The only way to do that is to import the difference.

There’s a financial side to the trade deficit, too. Carrying a trade deficit is useful when a country wants to avoid raising taxes or cutting budgets to fund government spending. The U.S budget deficit hit $873 billion in fiscal 2018, and is expected to reach $1.02 trillion this year, according to the Forecast. Assuming last year’s tax cuts stick, the Forecast puts that figure at $1.1 trillion by 2021.

That deficit must be financed in the same way a mortgage lender is necessary to make up the difference between what a home buyer can pay at the time of purchase and the amount the seller demands.

Right now, the U.S. trade deficit is a big help in financing the government budget deficit, the Forecast notes. A significant part of America’s chronic trade deficit is the result of foreigners’ buying U.S. government debt as well as U.S. stocks, real estate, companies and other assets.

If the overall amount of foreign investment here declines, the cost of funding the government debt rises; less demand for its bonds means it would have to pay higher interest rates to sell them. Higher interest rates would discourage spending by U.S. consumers and businesses, Feldstein explained. Higher interest rates make home mortgages and business lines of credit more expensive.

Feldstein made clear that Americans have the power to lower the trade deficit at will: by saving more than they invest. But would a lower trade deficit drop unemployment, increase incomes or otherwise enhance the U.S. economy?

Thriftiness is the last thing the U.S. economy needs right now. The core economy is growing at a not-very-reassuring 1.2 percent, according to the Forecast. At less than 1 percent growth (which is a good possibility if austerity catches on), the risk of a recession late in 2020 becomes very real, according to the study.

The inconvenient truth this time? That a reduction in the trade deficit could very well come with economic consequences no one wants.

Featured Faculty

-

David Shulman

Senior Economist Emeritus, UCLA Anderson Forecast

-

William Yu

Economist, UCLA Anderson Forecast

-

Jerry Nickelsburg

Adjunct Full Professor and Director, UCLA Anderson Forecast

About the Research

McBride, J., & Chatzky, A. (2019). The U.S. trade deficit: How much does it matter? The Center on Foreign Relations.

Shulman, D. (2019). Fuzzy data, a slowing economy and a trade war. The UCLA Anderson Forecast for the Nation and California: June 2019 Report, 13–17.

Yu, W., & Nickelsburg, N. (2019). Trade skirmishes with a chance of more to follow. The UCLA Anderson Forecast for the Nation and California: June 2019 Report, 59–62.

Feldstein, M. (2017). Inconvenient truths about the U.S. trade deficit.