Topic: Investing

You Have Women on Your Board? Gender Inequality and the Choices of Foreign Fund Manager

How investment data and country rankings correlate on treatment of women

You Call That Fun? Why Individual Stock Investors Bother

Avanidhar Subrahmanyam studies how some investors’ gambling mentality affects share prices

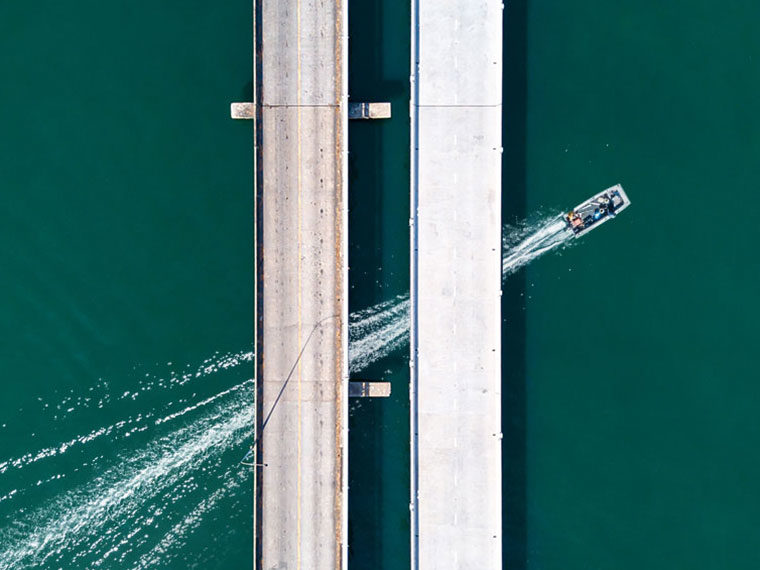

World Economy 9.6% Bigger Without Investment Barriers

In a model, cultural differences matter as much as geography, institutional distinctions or capital constraints

Why Would a Hedge Fund Manager Reveal Stock Positions?

A model suggests that the data might lead index funds to target those same stocks in oversight of corporate management

Why the Stock Market Needs Gamblers

They counteract the impulses of two other market personality types

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact

Why Rising Stocks Sometimes Reverse, Then Rally

Cultural differences and investor behavior can drive reversals and momentum

Why Big Banks Can Pay Less on Deposits

Their level of technology and services makes up for it; it’s vice versa with little banks

Who Gets Venture Capital?

Experienced founders with good products still need great employees to attract early investment, study finds

When Younger Investors Overreact to News, Others Feel It

Inexperienced investors, lacking historical context, impact markets

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

When Lenders Put a Muzzle on Borrowers

Companies hide from shareholders information about loans — more than likely to appease banks

When Individuals Concentrate in a Stock, Earnings Surprises Play Out Differently

Price movements can be more extreme

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

What Limited Attention Does to Efficient Market Theory

Stocks don’t react to news immediately because, well, we’re human

What Happens to Pesos When Dollars Go Digital?

As major central banks adopt digital currency, emerging countries will feel mixed effects