Topic: Taxes

Boo! Does Merely Mentioning an Audit Increase Taxpayer Compliance?

Research undermines the notion that companies coldly calculate tax avoidance

Are Interest Rates Really So Low?

Adjusting for inflation — and, crucially, for taxes — shows bond investors fare better than they might think

Setting the Tax Rate on Legal Marijuana: Consumption, State Revenue and the Black Market

Taxes not high enough? An examination of Washington’s experience even suggests state ownership of pot stores might boost the public coffers

Shaming of Tax Delinquents Works

34,334 letters were sent to test how sensitive those owing back taxes are to neighbors’ knowledge of the debts

Some Unfortunate Truths about Trade

The troublesome relationship between tariffs, trade deficits and the tenuous economic recovery

Forgoing a Tax Refund to Signal Brightening Financial Prospects

Companies that use loss carry-forwards to offset future tax liability, instead of claiming a refund, enjoy favorable lending terms

Businesses Vastly Overestimate the Likelihood of Being Audited

Should tax-collecting agencies keep audit activity secret to discourage cheating?

Small Enterprises Benefit from Economies of Scale in Marijuana Retailing

Washington state data: Profits higher, prices lower at multi-store firms

Philadelphia’s Soda Tax Is Nearly Perfect for Maximizing Revenue

It’s less successful at curbing consumption so buyers shop outside the city

Snap Quiz — This Is for Extra Credit

Welcome to UCLA Anderson Review’s quiz, in which we aim to extract business and life lessons from faculty research we cover each month.

World Economy 9.6% Bigger Without Investment Barriers

In a model, cultural differences matter as much as geography, institutional distinctions or capital constraints

State Tax Credits for Angel Investors Backfire

Good ideas may be scarce, capital to fund them is not

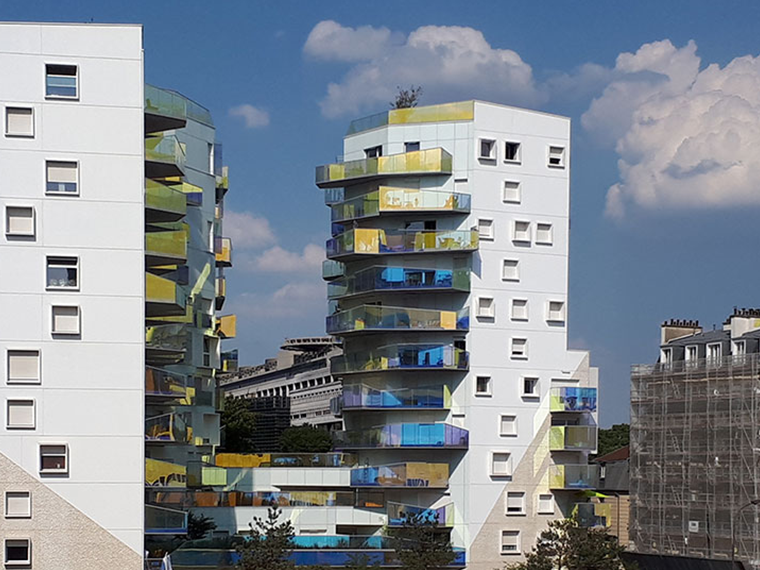

France, Forcing Municipal Mergers, Achieves Growth in Housing Units

Construction permitting power taken from cities that resisted development

How Tax Collections From Online Sales Rose

Putting the onus on retailers, rather than shoppers, works better

Trump’s Tariffs Did, In Fact, Hurt U.S. Importers

Companies with Chinese suppliers suffered — those with more diversified supply chains suffered more

A Simplified Tax Code and Post-Communist Growth

Study suggests flat tax systems boosted GDP in former Soviet republics and satellites