Topic: Taxes

World Economy 9.6% Bigger Without Investment Barriers

In a model, cultural differences matter as much as geography, institutional distinctions or capital constraints

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

Trump’s Tariffs Did, In Fact, Hurt U.S. Importers

Companies with Chinese suppliers suffered — those with more diversified supply chains suffered more

Taxing Jet Fuel Could Reduce Airline Greenhouse Gas Emissions Now

Breakthrough technologies are years off for aviation, but incremental improvements are available

State Tax Credits for Angel Investors Backfire

Good ideas may be scarce, capital to fund them is not

Some Unfortunate Truths about Trade

The troublesome relationship between tariffs, trade deficits and the tenuous economic recovery

Snap Quiz — This Is for Extra Credit

Welcome to UCLA Anderson Review’s quiz, in which we aim to extract business and life lessons from faculty research we cover each month.

Small Enterprises Benefit from Economies of Scale in Marijuana Retailing

Washington state data: Profits higher, prices lower at multi-store firms

Should Part-Time Californians, Avoiding the State’s Income Levy, Pay More in Property Tax?

As it stands, they’re free-riding, in effect subsidized by full-time resident taxpayers

Shaming of Tax Delinquents Works

34,334 letters were sent to test how sensitive those owing back taxes are to neighbors’ knowledge of the debts

Setting the Tax Rate on Legal Marijuana: Consumption, State Revenue and the Black Market

Taxes not high enough? An examination of Washington’s experience even suggests state ownership of pot stores might boost the public coffers

Philadelphia’s Soda Tax Is Nearly Perfect for Maximizing Revenue

It’s less successful at curbing consumption so buyers shop outside the city

Oversight of Borrowed Money Creates Animosity

Friends lending to friends, taxpayers bailing out businesses feel it’s still their money and have opinions on how it’s spent

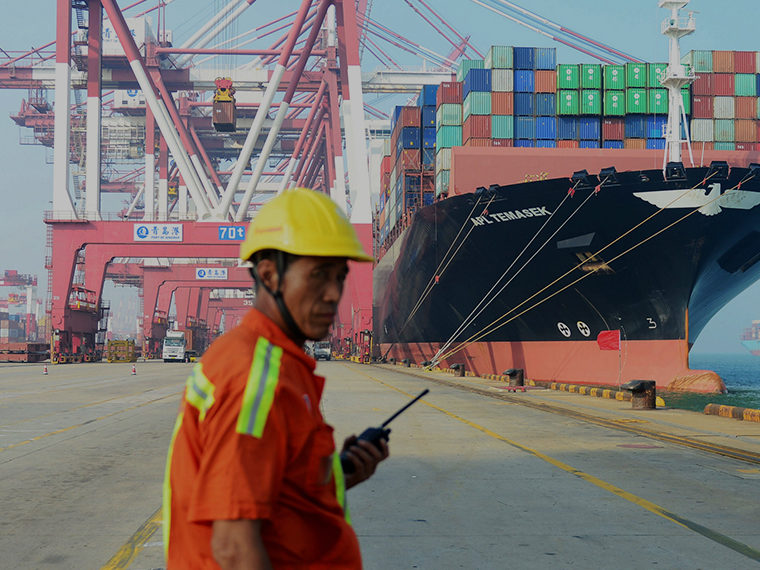

In U.S.-China Trade War, Bystander Countries Increase Exports

Higher demand from U.S. and China means expanding into new markets

How Tax Collections From Online Sales Rose

Putting the onus on retailers, rather than shoppers, works better

France, Forcing Municipal Mergers, Achieves Growth in Housing Units

Construction permitting power taken from cities that resisted development