The Latest

We Hate Crowds, But Fail to Strategize on Avoiding Them

When might most other people choose to visit the bank?

Was Research — on Physicians and Noncompete Agreements — Before Its Time?

Years after a paper goes unpublished, it’s fodder for a major Federal Trade Commission proposal

Warmth vs. Competence: a Way to Organize Study of Job, Gender and Racial Stereotypes?

Nurses (and women) rate highly for warmth; lawyers, not so much

Want To Elicit User-Generated Content? Try User-Generated Rewards

Recognition by peers leads to longer, more thoughtful online reviews and discussion threads

Want More Charging Stations? Spur Purchases of More EVs

Governments needn’t subsidize charging networks

Wage Transparency Might Make Income Inequality Even Worse

Unintended consequences in trying to apply market solutions

Voters Often Opt for Candidate They Expect to Win

The bandwagon effect boosts the top vote-getter in preliminary rounds

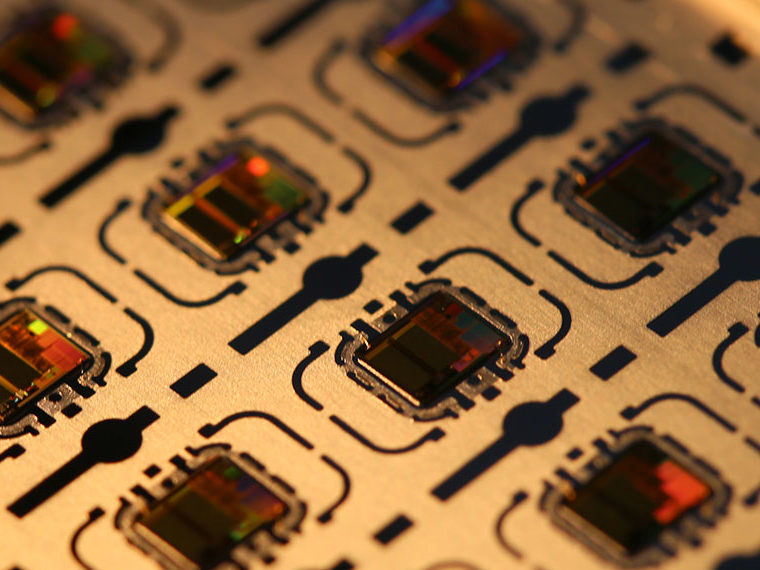

Volume Discount? In the Chip Industry, Don’t Count on One

Semiconductor makers’ pricing is based not just on quantities ordered but also on “capacity rationing”

Viewing Multiracial People as Resilient, Rather than Burdened

Revisiting decades of research, scholars find a theory of psychological strength emerges

Vacation Mindset: How Weekends Can Be More Refreshing

Researchers told subjects to treat their weekend like a vacation, then gauged happiness on Monday

Using Ancestral Characteristics to Study Modern Economics

A database of pre-industrial sampling supports historical and ethnographic research

Upside Earnings Surprise Issued Late: Signal of Possible Manipulation

Companies that take longer than expected to announce results may be buying time for accounting tricks

Unwelcome Gift Message: ‘I Know You Need Money’

The same gift, with a message on saving the recipient time, is more welcome

Unvarnished Merger Talk: Will This Deal Help Us Raise Prices?

Customer loyalty, barriers to entry and other factors at play

Unintentionally, EU Data Protections Impede Development of New Medicines

That’s bad for patients, who’re the citizens the privacy law means to help