Topic: Debt

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

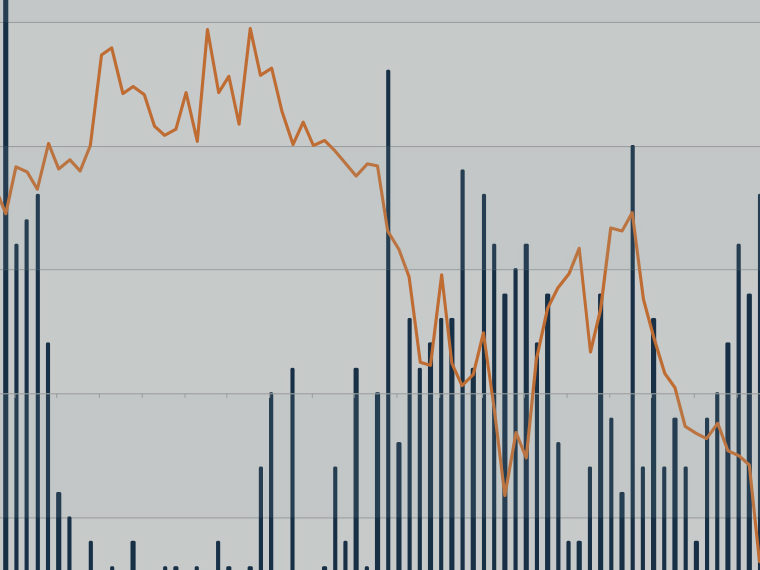

What Makes a True Financial Crisis?

Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

Some Homeowners Pay Their Underwater Mortgages Until the Government Offers a Better Option

Federal loan modification program led borrowers to default

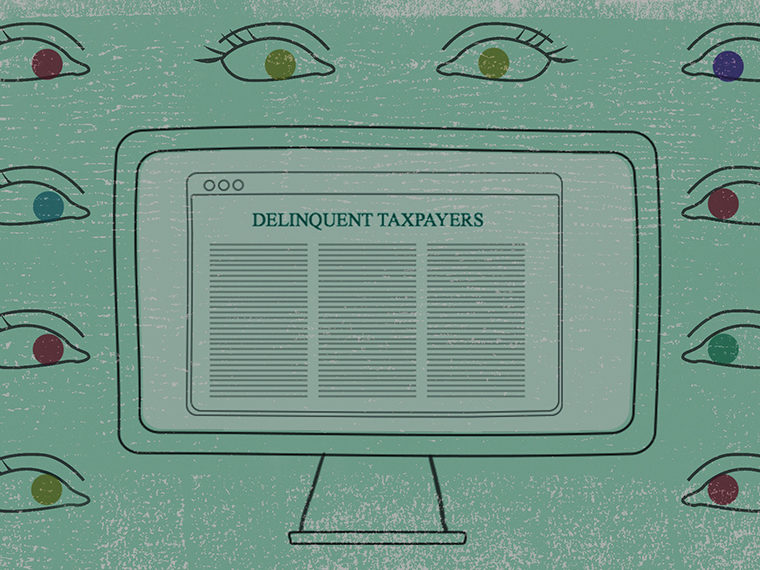

Shaming of Tax Delinquents Works

34,334 letters were sent to test how sensitive those owing back taxes are to neighbors’ knowledge of the debts

Sensitivity to Debt Type Predicts Financial Health

Research reveals that those wary of payday loans tend to manage their finances better

Quantitative Easing Kept the Foreclosure Crisis from Being Even Worse

The Fed’s gambit didn’t trigger a home-price recovery, but research shows it reduced subprime foreclosure risk

Oversight of Borrowed Money Creates Animosity

Friends lending to friends, taxpayers bailing out businesses feel it’s still their money and have opinions on how it’s spent

One European Country Defaults: How Hard-Hit Is the Euro?

A predictive model employs credit default swaps across currencies

Municipal Pension Crisis Made Worse by Democrats in Close Elections

Sixty years of data suggest retirement obligations rise after Democrats scrape into office

Modern Monetary Theory: Fiasco in Latin America, Option in U.S.?

The populist model, embraced by some on the American left, resembles policy that helped torpedo some smaller economies

Medical Debt in Collection Estimated at $140 Billion

Poorer residents of states refusing to expand Medicaid hit hardest

Less Leveraged Than the Competition: Ready to Snag Distressed Assets in a Recession

When bad times hit, highly indebted companies often have to sell operations and equipment at fire-sale prices