Topic: Personal Finance

Does Spending Mean You’re Wealthy?

To many, yes, and that belief leads to lower levels of financial well-being

Consumer Spending and Jobless Data: a Peculiar Threshold

A 12-month high in local unemployment triggers savings behavior

Education Pays Off Handsomely, but Borrowing for It Makes People Unhappy

Student debt weighs on happiness more than mortgages or credit card loans

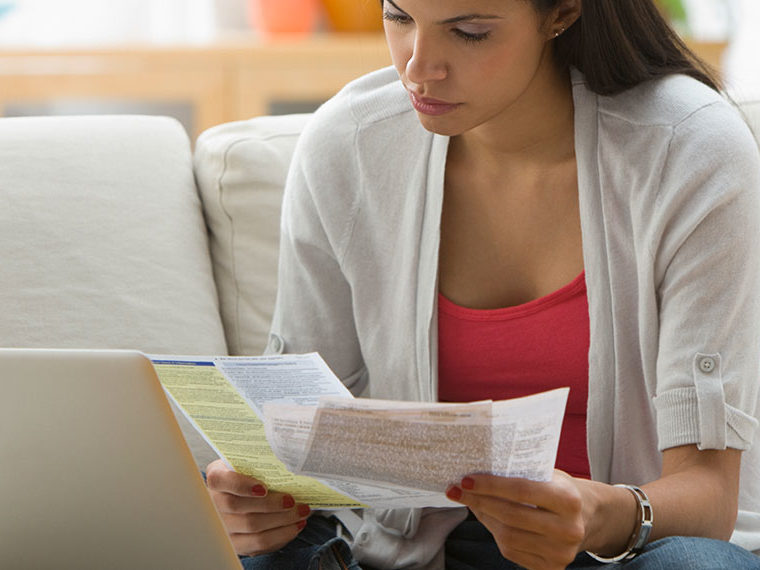

Rising Rents Force Families to Curtail Spending on Food and Health Care

Cost burdens affect half of U.S. households that rent, as housing shortage worsens

Americans Sacrifice $3.4 Trillion by Claiming Social Security Too Soon

Can nudges, tailored to personality traits, persuade retirees to wait?

Good Information Alone Won’t Drive Financial Well-Being

A review of academic research finds the path to saving more and spending less often involves emotional prompts

Maximizing Retirement Savings: More Nudging Required

Tweaking 401(k) website design and language can significantly boost worker contributions, yet HR doesn’t always see these opportunities

How Will You Spend Your IPO Windfall?

“Uh, I already bought a house”: Tech workers spend ahead of actual stock sales

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

Joint Bank Accounts Make for Happier Couples

Those who keep finances separate are likelier to split up, be less satisfied with their relationship

Helping People Make Wise Decisions for Retirement Income

Nudges, long aimed at saving behavior, are needed for people converting a nest egg into income

Culture Affects How People Save Money

Immigrants show saving tendencies that carry through several generations

New Appreciation for a Classic Stock Market Gauge

The relationship between short- and longer-term moving averages has strong predictive power for share price returns

Momentum Investing: It Works, But Why?

After a quarter century of sprawling study, it’s time to narrow the focus and settle on an explanation