Topic: Government

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

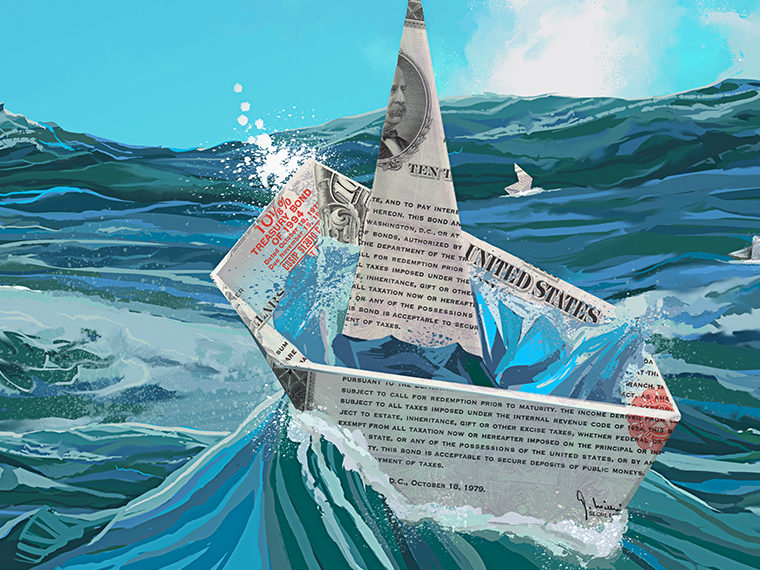

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

A Cash-for-Clunkers Program Could Reduce Aviation Emissions

Paying airlines to scrap — instead of sell — old planes produces environmental benefits at a low cost

A Proposal to Even Out Flu Vaccine Supplies

A system of manufacturer rewards and penalties, consumer taxes and subsidies could aid vaccination rates

A Simplified Tax Code and Post-Communist Growth

Study suggests flat tax systems boosted GDP in former Soviet republics and satellites

A Tool for Uncovering Voter Suppression

Smartphone data reveals that wait times at the polls are much longer for black people

A Tool to Make FDA Drug Approval Practices Transparent

Researchers aim to help the agency, drug companies and patients better understand the complex authorization process

Bribery and the Motivation of Bidders on Foreign Contracts

Do bigger companies win even when they lose out on corrupt deals?

Businesses Vastly Overestimate the Likelihood of Being Audited

Should tax-collecting agencies keep audit activity secret to discourage cheating?

Chinese Citizens, Given Voice in Local Budgeting, Are More Satisfied With Country’s Regime — and Want More From It

Taste of democracy engenders the opposite of cynicism

Citizens Are Not Fooled by Fake Statistics

What happened when the Argentine government lied about inflation numbers?

Comprehensive COVID-19 Screening Would Pay for Itself Many Times Over

Reliable, widespread testing regimen could help jump-start economy

Do Private Prisons Lead to Higher Incarceration Rates?

Researchers take on the difficult job of isolating for-profit prisons from a host of other factors

Economic and Ideological Predictors of the Unique U.S. COVID-19 Failure

Examining local-level plans and behavior to uncover drivers of failed compliance with expert advice

Exploring the Relationship between Off-Label Prescriptions and Clinical Trials

A study looks at how changes in FDA labeling affect pediatric utilization of drugs

France, Forcing Municipal Mergers, Achieves Growth in Housing Units

Construction permitting power taken from cities that resisted development