Topic: Personal Finance

Sensitivity to Debt Type Predicts Financial Health

Research reveals that those wary of payday loans tend to manage their finances better

Taking the Battle for Financial Literacy to Where the Eyeballs Are

Research by Bruce Carlin and Stephen Spiller suggests YouTube videos could help consumers make better money decisions

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system

Ignorance — About One’s Investments, Anyway — Isn’t Always Bliss

Valentin Haddad’s research looks at the phenomenon of “information aversion,” when individual investors stop tracking their portfolios for fear of bad news

Momentum Investing: It Works, But Why?

After a quarter century of sprawling study, it’s time to narrow the focus and settle on an explanation

New Appreciation for a Classic Stock Market Gauge

The relationship between short- and longer-term moving averages has strong predictive power for share price returns

Culture Affects How People Save Money

Immigrants show saving tendencies that carry through several generations

Helping People Make Wise Decisions for Retirement Income

Nudges, long aimed at saving behavior, are needed for people converting a nest egg into income

Joint Bank Accounts Make for Happier Couples

Those who keep finances separate are likelier to split up, be less satisfied with their relationship

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

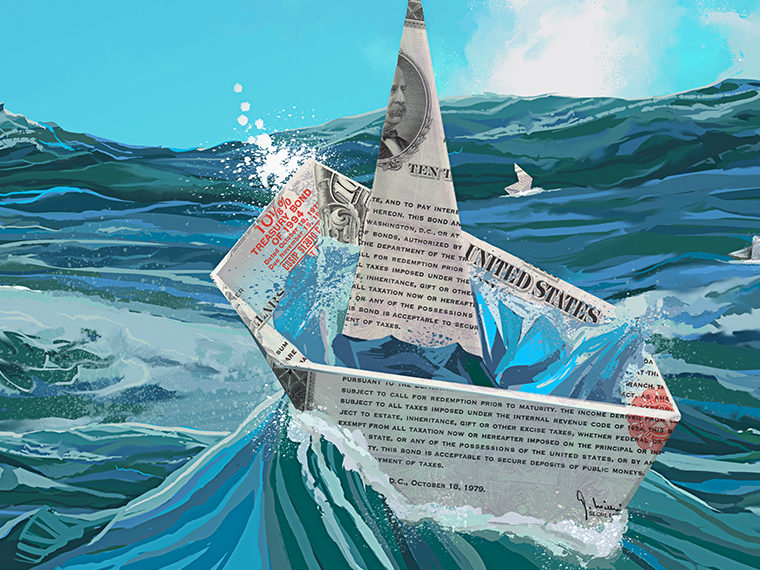

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

How Will You Spend Your IPO Windfall?

“Uh, I already bought a house”: Tech workers spend ahead of actual stock sales

Maximizing Retirement Savings: More Nudging Required

Tweaking 401(k) website design and language can significantly boost worker contributions, yet HR doesn’t always see these opportunities

Good Information Alone Won’t Drive Financial Well-Being

A review of academic research finds the path to saving more and spending less often involves emotional prompts

Americans Sacrifice $3.4 Trillion by Claiming Social Security Too Soon

Can nudges, tailored to personality traits, persuade retirees to wait?