Hal Hershfield

Professor of Marketing and Behavioral Decision Making

About

Psychologist Hal Hershfield studies how thinking about time transforms the emotions and alters the judgments and decisions people make. One of Hershfield’s most well known discoveries suggests that when people are confronted with their “future selves,” they experience an emotional sense of connection that can influence long-term financial and ethical decision making.

Topics

33 Articles

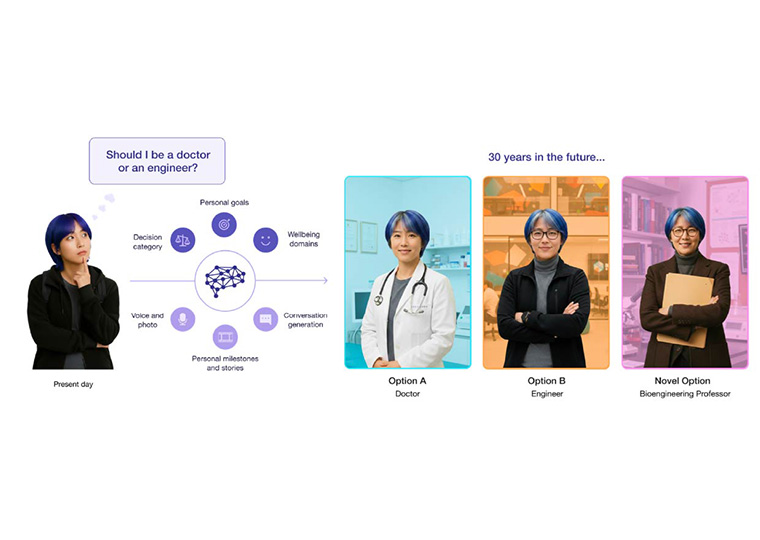

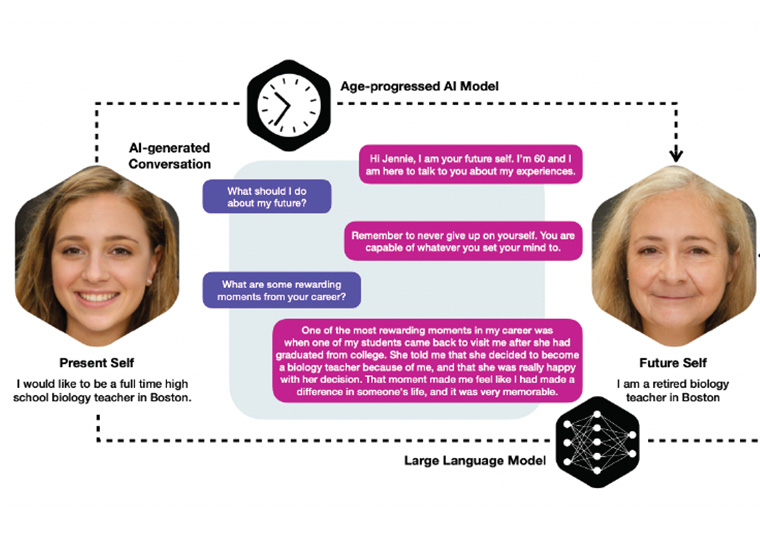

As AI Advances, Tools to Connect to Your Future Self Grow More Vivid and Useful

Digital twins, 30 years your senior, help weigh today’s big decisions

Nudging Teachers, in a Large Field Study, Marginally Boosted Student Math Performance

Fifteen nudges tried out across 140,000 teachers and some 3 million students

Math Study Shows Difficulty in Motivating Teachers to Change Behaviors

Nudging educators to use an online math platform did surprisingly little to increase usage or student success. Even Judy Blume couldn’t help.

Wealth Building Behavioral Trait Holds Up in Large-Scale Study

Feeling connected to — not estranged from — our older self is associated with savings and other helpful present-day behaviors

AI Has Shown Me My Future. Here’s What I’ve Learned.

A new artificial-intelligence tool allowed me to talk to my 80-year-old self. It’s going to be quite a life.

Young Adults, With an AI Bot, Chat With Their 60-Year-Old Selves

Research progresses on forging closer bonds with our future selves, encouraging behavior helpful to later lives

Future-self Nudge Works Even Better in Reverse

Starting with your future self and looking back to your current self increases likelihood of saving

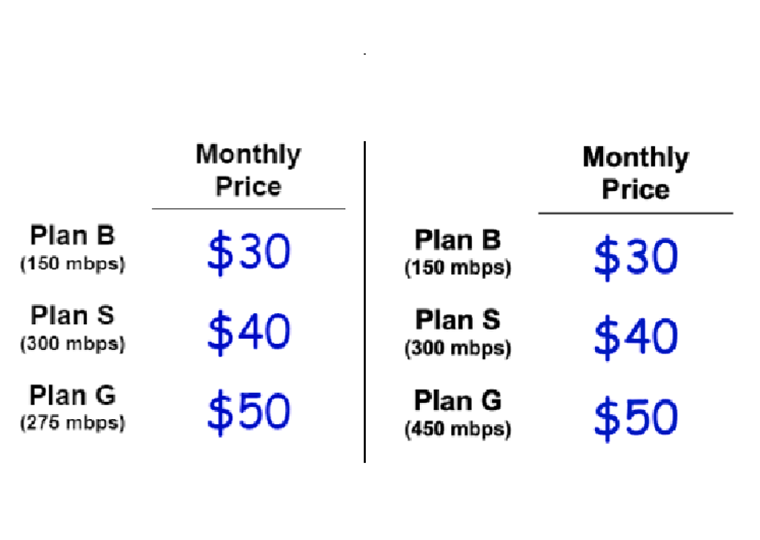

A Common Marketing Nudge Can Foster Consumer Distrust

Placing an inferior ‘decoy’ option in a menu of choices can trigger people to take their business elsewhere

Thinking in Days, Weeks, Years — Rather Than Minutes — Can Bring Contentment

A broader view of one’s time also changes how one spends it

Major Adolescent Stress Reduces Connection to Future Self

And thinking less about one’s adult life can reduce the pursuit of higher education

The Benefits of Getting to Know Your Future Self

Many of us feel little connection with the person we’ll be decades from now. That can lead to shortsighted behavior that hurts us in the long run.

Overcoming Obstacles to Taking Better Care of Your Future Self

Hal Hershfield’s book offers research-backed methods to build a healthier, happier, more financially secure life

The Relationship Between Adoption of Rooftop Solar and Attachment to One’s Surroundings

Applying the behavioral concept of “place attachment” to the logistics of battling climate change

The Sad Fact of Reminiscing About Good Times

Happy memories of life-stage transitions can be bittersweet

Too Much Free Time? Blame Solitude or Lack of Productive Activity

Even abundant free time, used in meaningful pursuits, brings happiness

How a ‘self-nudge’ could help you make better money and life decisions

New research provides a useful toolkit for hacking your brain to stop from fumbling your finances

Alcohol Use and Violent Crime: a 36% Shorter Sentence

Intoxication seems to work as an unofficial mitigating factor

How to — and How Not to — Message Older Americans

Practitioners often ignore decades of progress in understanding what works

Does Spending Mean You’re Wealthy?

To many, yes, and that belief leads to lower levels of financial well-being

Did You Forget, or Never Know? How It Impacts Purchasing

A different decision tree is used when product information is forgotten, rather than just unknown

Americans Sacrifice $3.4 Trillion by Claiming Social Security Too Soon

Can nudges, tailored to personality traits, persuade retirees to wait?

Good Information Alone Won’t Drive Financial Well-Being

A review of academic research finds the path to saving more and spending less often involves emotional prompts

Origin Story of Products: To Consumers, How Big a Team Seems Right?

Buyers value team over individual effort but are sensitive to invention-by-committee

Creative People Really Do Think Differently

Employing a distinct part of the brain, they’re better at imagining a distant future and seeing others’ points of view

Advancing the Study of Using Future-Self Images to Alter Behavior

Successful projects suggest a more thorough cataloging of how “vividness” nudges can help us delay gratification

The Healthy Upside of Thinking about an Older You

Consciously imagining our older self can spur us to take better care of ourselves now

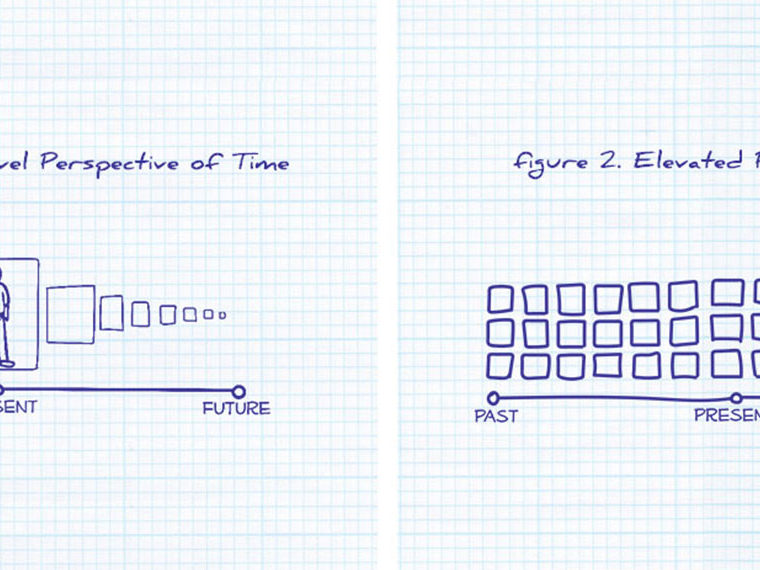

An Aerial, as Opposed to Ground-Level, View of Time

A novel framework proposes to reduce angst over schedules and lives

Behavioral Nudges Timed to Certain Days are Effective Motivator

Dates of milestones — major and minor — can spur us to action

Thinking Small Could Deliver Bigger Retirement Success for Gig Workers

Daily, weekly and monthly contribution schemes gauge behavior

Our Flawed Pursuit of Happiness — and How to Get It Right

New approaches to spending and time-management examine how our actions do or don’t influence our level of satisfaction

Sensitivity to Debt Type Predicts Financial Health

Research reveals that those wary of payday loans tend to manage their finances better